The Legacy Perspective - January 2020

By Steve Wachs CFP®

“We have long felt that the only value of stock forecasters is to make fortune-tellers look good. Even now, Charlie (Munger) and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

-Warren Buffett

As we welcome a new decade, one thing that doesn’t change is all the pundits and experts offering their predictions on what we will experience in the financial markets in the coming year. Warren Buffet, one of the greatest investors, clearly states his opinion on such forecasts. Evaluation Ranking of Market Forecasters, covering 6,627 market forecasts (specifically for the S&P 500 Index) made by 68 forecasters who employed technical, fundamental and sentiment indicators, from the period 1998 through 2012, found across all forecasts, accuracy was 48% – worse than the proverbial flip of a coin. So why do these forecasts continue to be made? First, like trying to complete your NCAA March Madness basketball bracket, it is fun. Second, as Jason Zweig, a Wall Street Journal columnist, states, “Whenever some analyst seems to know what he’s talking about, remember that pigs will fly before he’ll ever release a full list of his past forecasts, including the bloopers.” You don’t have to be right as no one really remembers your prediction or holds you accountable.With that as an introduction, let’s be bold and actually share what we predicted last year at this time and offer our thoughts for 2020. We are confident you have saved last year’s Legacy Perspective in a treasured place, but in case you have not, here is what we shared.

2019 - Slower U.S. economic growth. We do not see an economic recession.

Give us an “A” on that prediction. Recession talk was front and center as we entered 2019. Although the economy slowed (like great Texas BBQ, this has a been a low and slow economy), we did not enter a recession. For 2020, we anticipate a similar growth pattern and no recession. Year-over-year corporate earnings may be stronger this year and global economic growth may accelerate from the doldrums; especially if tariff issues continue to be resolved.

2019 - Inflation will remain tame.

Give us another “A.” Last year, inflation was less than 2%. We expect that to continue for 2020. Even though wage inflation remained suppressed, low unemployment and lack of trained employees could cause that to change and is something we are watching.

2019 -Higher stock market volatility will continue.

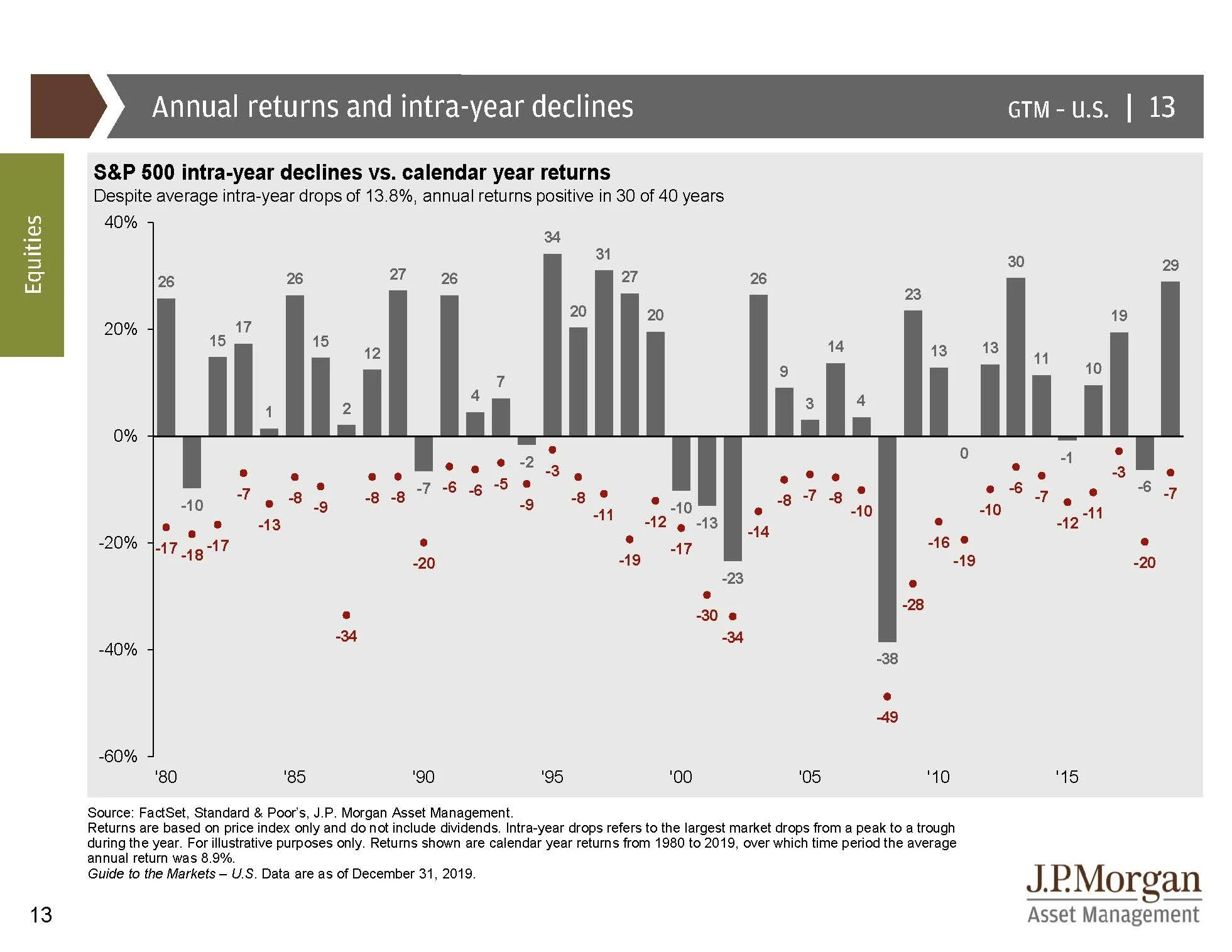

We will have to give us a “B” on this prediction. There was some volatility in 2019, but the largest intra-year decline was only -7.0%. The average intra-year decline for the S&P 500 Index since 1980 is -13.9%. This is represented in the following chart. We would expect at some point in 2020, the S&P 500 index will decline by more than 10% which would be categorized as a correction.

2019 -“Ok” returns for both stocks and bonds.

We get a “D” for this forecast. The Federal Reserve changed course and reduced rates at the beginning of 2019 and both equity and fixed income returns were stellar. The S&P 500 index was up 30.4% and the Barclays U.S. Aggregate Bond index increased by 8.7%. Our guess is that U.S. stocks will increase by over 10% at some point in 2020 with month-to-month volatility being higher as referenced above. Fixed income returns will drop back into a more normal range of 3% - 5%.For extra credit, we are giving you a bonus prediction. This is longer term in nature, but we expect specific international companies will outperform U.S. ones. The following chart reflects the huge divergence over the last decade between U.S. and international stocks. In 2019, international equities represented by the MSCI ACWI Ex USA index increased by 21.5%, a nice return, but almost 9% less than the S&P 500 index. Interestingly, 37 of the 50 best performing stocks for 2019 were based on foreign soil. The international managers we have chosen can identify outstanding companies that are trading at more attractive valuations than their U.S. counterparts. This does not mean we are making a big short-term bet on international stocks. It does mean we believe our international equity investments could outperform the U.S. stock index in the next few years.Although making and reading predictions is fun, it never will be the basis of our investment philosophy. Over the 20-year period from 1/1/1999 to 12/31/2018, if you missed only the 10 best days in the stock market, your overall return was reduced by over half. Short-term market timing is a losing proposition. We can’t predict, but we can prepare. Given the strong performance of 2019, we have captured gains to make sure any planned distributions for 2020 have been set aside. When volatility increases, we will be able to take advantage with systematic rebalancing which affords the ability to “buy low.” Most importantly, and unlike many of the pundits who toss out their predictions, we embrace accountability and will be present to both look back and look ahead to keep you on your path to financial independence.

Disclosures

Legacy Consulting Group is registered as an investment adviser with the SEC and only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Information presented is believed to be current. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. You should consult with a professional advisor before implementing any strategies discussed.

All investments and strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. There is no guarantee that a specific investment or strategy will be suitable or profitable for an investor’s portfolio. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark.

Historical performance returns for investment indexes and/or categories, usually do not deduct transaction and/or custodial charges or an advisory fee, which would decrease historical performance results.