Clarity for Heirs!

by Drew Schlotter, CFP®, CCFC

In 2019, Congress changed the rules around inherited retirement accounts. Historically, when a non-spouse inherited a retirement account, they could draw down the account across their lifetime by making Required Minimum Distributions or RMDs based on their age. The new law required beneficiaries to withdraw the funds by the end of the 10th year after the original owner died. However, the original language of the law was unclear. Do you have to take out a certain amount each year during those 10 years, or could you wait until year 10 and then take out the entire amount? Last week, on July 18, the IRS provided their finalized clarification. Let’s talk about their final verdict, what it might mean for you and how to avoid some serious penalties.

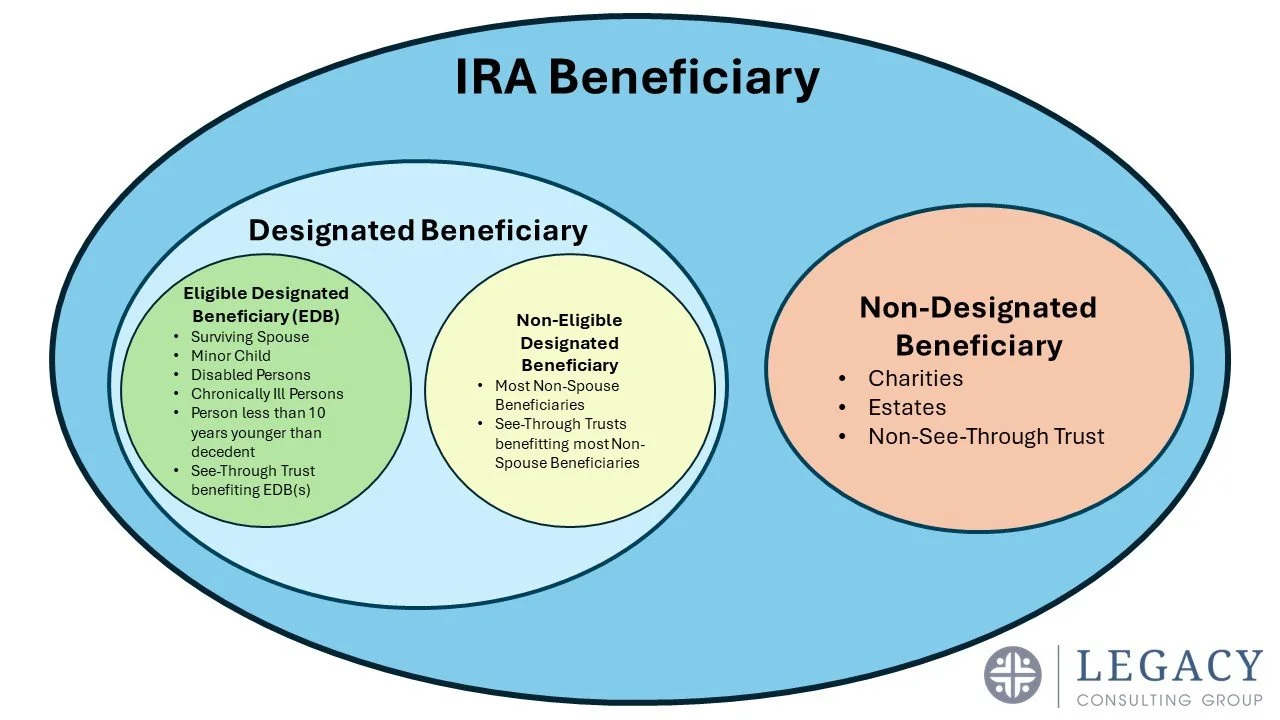

Before we get started, a notable exception to the rule is what the IRS deems “Eligible designated beneficiaries,” which includes surviving spouse, minor children and disable or chronically ill individuals. They each have their own set of rules to follow.

For today, let’s focus on the rules for people who are not Eligible Designated Beneficiaries (i.e. NOT spouses, minor children or disabled). The IRS’s ruling establishes 2 different sets of rules around the 10-year rule based on the age and distribution status of the original owner at the time of death.

If the original owner was not taking RMDs, then the beneficiary can withdraw the funds at any time until December 31 of the 10th year after the owner’s death. These beneficiaries have a lot of flexibility within those 10 years. You could take out some each year or wait until year 10. Just make sure you have withdrawn all of the funds before the end of year 10.

On the other hand, if you inherit a retirement account from an owner who was required to make RMDs, then you will also have to take RMDs. As the beneficiary, your RMDs will be calculated based on your life expectancy, but the 10-year rule still applies. This means you can take out just your RMDs for years 1-9, but in year 10, you will need to withdraw anything that is left in the account.

Now, the good news is, if you inherited a retirement account from 2020 through 2024, but didn’t take your RMDs, the IRS is giving you a pass due to the confusion. You will just need to start taking the required withdrawals in 2025 and going forward. You are also not required to take a large lump distribution in 2025 to make up for any missed withdrawals. For example, if you inherited an IRA in 2022 but have not taken any distributions yet, you just need to follow the new rules going forward and have until the end of 2032 to withdraw all the funds from the account.

So, what does the IRS ruling mean for you? If you inherit a retirement account and the original owner was under age 73, then you can wait and withdraw everything in year 10. If the original owner was over age 73 and taking RMDs, then you can just take RMDs and then withdraw the remainder in year 10. But just because you can, doesn’t mean you SHOULD. Depending on your income and how large the inherited account is, waiting until year 10 to take out all or most of the funds could push you into higher tax brackets. A better strategy may be to withdraw more during years with lower income, and less during high income years, while making sure to always meet at least the RMD requirements. This would allow for more of the money to be taxed at lower rates.

What about Roth IRAs? Roth IRAs must be distributed by the end of the 10th year, but there is no RMD and usually no tax.

What happens if you miss an RMD or don’t empty the retirement account by the end of the 10th year? The penalty for missed withdrawals is 25% of the amount that should have been withdrawn. Ouch!

Talk with your financial advisor to make sure you know how much money and when you need to distribute from your inherited retirement accounts. At Legacy Consulting Group, this is something we take care of for clients all the time. If you would like guidance building a plan to manage inherited accounts or anything else, we would love to discuss how we can help.

Disclosures

Legacy Consulting Group is registered as an investment adviser with the SEC and only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Information presented is believed to be current. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. You should consult with a professional advisor before implementing any strategies discussed.

All investments and strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. There is no guarantee that a specific investment or strategy will be suitable or profitable for an investor’s portfolio. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark.