The Legacy Perspective - January 2025

by Steve Wachs, CFP®

It is a new year so New Year’s resolutions are upon us. Some may have already gone by the wayside as research shows most of the individuals’ commitment to their resolutions have ended in less than 30 days. The investment team has set the following two resolutions for 2025, and we will not give up.

1. Control what you can control

2. Say yes to opportunities

Control What You Can Control

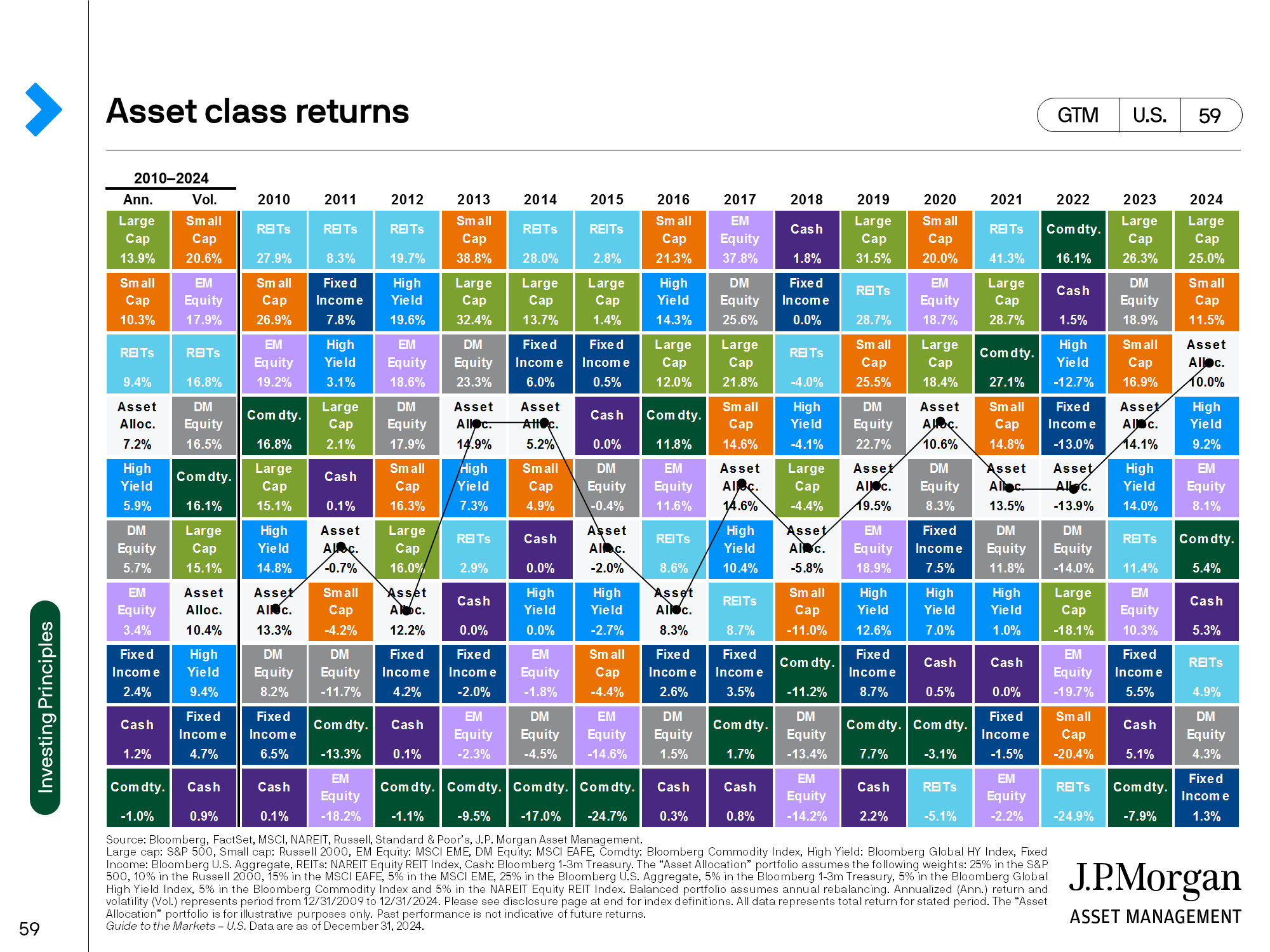

The “Periodic Table” below shows the asset class returns ranked in order for each year since 2010. The S&P Index (represented by the green color on the chart below) performed remarkably well over the past 2 years. In fact, only one asset class (commodities) had a negative return during that same timeframe. That is quite a contrast to 2022 when only 2 asset classes (commodities and cash) had positive returns. We would love to be able to control what the equity markets are going to do, but that is not a resolution we could keep. We can control your asset allocation. That is the mix of the different asset classes that is based on the timeframe of your goals, when distributions will be needed, and your risk tolerance. Asset Allocation (the white box with the line represents a mix of different investment indices) returns will never be at the top, but more importantly, will never be at the bottom. The technical investment term for this is managing downside risk. Asset allocation also allows us to control the discipline needed to rebalance a portfolio. Rebalancing is counterintuitive because you are selling investments that have gone up and buying ones that have declined. It is not easy, but it is extremely important so your investment portfolio is not subject to a higher degree of risk than you would be comfortable with. Finally, your role in allowing us to control what we can control is to let us know if any of your financial goals have changed and most importantly, if any planned distribution needs have been modified.

Say Yes to Opportunities

The following chart illustrates calendar returns of the S&P 500 Index over the past 45 years, and the “intra-year” declines for each of those years. As the chart states, returns were positive in 34 of the 45 years with an average intra-year drop of over 14%. From a statistical standpoint, it would seem investing in equities is easy as positive annual returns are generated over 75% of the time and declines in value are temporary. However, it is those declines that make investing difficult. When double digit declines in values occur, fear comes front and center. As we have communicated before, it is ok to feel fear, but you cannot let emotion dictate investment action. It is during these times that we can say yes to opportunities. Let’s look at the chart and some of those opportunities. In 2020, the Covid crash surfaced with S&P 500 Index declining 34% from February 20th to April 7th. The fear light was flashing red! We did the research and were able to add a fund to many portfolios that specialized in healthcare companies and a stock that was a leader in cybersecurity as companies were moving to employees working remotely. Both performed very well. 2022 was a challenging year for all investment categories. During the 4th quarter of that year, we were able to increase our equity exposure and position the fixed income positions that led to superior performance the past 2 years. The investment team does not make predictions, but we would not be surprised to see an intra-year decline of over 10% sometime this year.

So, control what you can control and say yes to opportunities. Not just resolutions for the investment team, but maybe ones each one of us could take to heart. Happy New Year to each one of you!

Disclosures

Legacy Consulting Group is registered as an investment adviser with the SEC and only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Information presented is believed to be current. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. You should consult with a professional advisor before implementing any strategies discussed.

All investments and strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. There is no guarantee that a specific investment or strategy will be suitable or profitable for an investor’s portfolio. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark.